How to Handle Foreclosure in Probate

If you’re the Personal Representative in a probate estate and the decedent owned real property, you may be wondering how to handle foreclosure in probate. In this blog post, we’ll cover why probate estates sometimes risk foreclosure, how to prevent foreclosure, and how to handle a Notice of Default as Personal Representative.

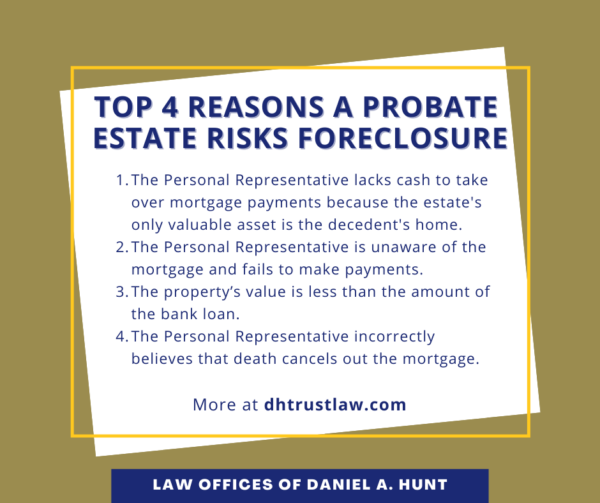

Why Are Probate Estates At Risk for Foreclosure?

An estate may default on a decedent’s mortgage for any of the following reasons:

- The estate’s only valuable asset is the real property and the Personal Representative lacks the cash to take over the mortgage payments.

- The Personal Representative is unaware of the mortgage and fails to make payments.

- The property’s value is less than the amount of the bank loan.

- The Personal Representative incorrectly believes that death cancels out the mortgage. California law does not erase a mortgage upon the owner’s death, nor does it allow you to delay mortgage payments until the property is sold. If mortgage payments aren’t made in a timely manner, the lender can foreclose on the property.

How to Prevent Foreclosure in Probate

Early prevention is the best approach to preventing foreclosure. Be sure to keep all secured loans current during the estate administration. If any real estate is subject to a mortgage, first consult with your probate lawyer on the best course of action. Then the Personal Representative should immediately write to the lender, provide your mailing address, notify them of the decedent’s death, and explain what you plan to do with the property. Clear communication reduces the risk of foreclosure.

Be sure to document this information by sending communications via Certified Mail. This may be important later down the line if you need to stop the foreclosure. If you can prove that you provided the lender with your contact information and the lender failed to properly notify you of the foreclosure, this may be one way to buy yourself some time to sell the property before foreclosure.

If the estate is insolvent and cannot afford to pay the mortgage, but there is equity in the property, tell this to the lender and let them know you are preparing the property for sale. If you tell them early on in the estate administration, they may be willing to give you extra time to sell the house. If there is no equity in the property, ask the bank if they will accept a deed to the house instead of foreclosing or inquire about a short sale on the property. An experienced probate attorney can help you find the best strategy given your unique circumstances.

What If You Receive a Notice of Foreclosure?

If you as Personal Representative receive a Notice of Default from the lender, here are some of your options.

- Contact the lender, find the person with the authority to stop the foreclosure, and ask for more time. The sooner in the probate process you do this, the better your odds of success.

- If the lender is unwilling to cooperate, seek to enjoin (or prevent) the foreclosure. You may be able to succeed by arguing that the lender failed to send proper notice to you of the foreclosure sale. This would force the lender to begin the foreclosure process over again and buy you more time.

- You may wish to consider borrowing funds from another lender until the property can be sold. Be aware that due to the risk, the interest on such a loan will likely be high. The personal representative could also take out a personal loan, but do note that this makes you personally liable for the debt.

How to Distribute Real Estate Sale Proceeds

If you are able to buy enough time to sell the property, you must distribute the sale proceeds in the following order:

- Estate administration expenses related to the administration of the property (including statutory probate fees for the executor and attorney and funds set aside until there is a court order to distribute them);

- Paying expenses of the sale;

- Paying and satisfying the amount secured by the lien on the property sold (if required under the terms of the sale);

- After paying all of the above, if there is any money remaining, it goes to the estate.

Handling a foreclosure in a probate estate can be stressful and difficult, but not always impossible. Remember that the earlier you address this issue, the better your odds of success. If you need help handling a foreclosure in probate, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.